Mannheim, March 28, 2019 – The financial and insurance world is in the midst of major changes. The number of digital services offered by banks and insurance companies is steadily increasing, but how do consumers respond to these offers? A recent survey from Spiegel Institut in Mannheim provides insights into the behavior, needs, and desires of consumers when dealing with financial matters on the internet.

In addition to direct insurance and direct banking offers, which have mostly been set up by traditional institutions, new service providers have entered the market in the past few years, offering digital solutions for managing or acquiring insurance and financial products. The Customer Journey, i.e., the points of contact that a customer experiences with a product or service before she decides to buy, is increasingly merging with the User Journey, which previously focused only on digital products. The analog and digital worlds are becoming more and more intertwined.

Currently, digital asset management is a topic that stands out. Moreover, entirely new insurance concepts will emerge in the coming months and years, which are likely to disrupt the market in a similar way as AirBnb did in the hotel industry or Uber in the taxi industry.

Given this situation, Spiegel Institut Mannheim, the research and consulting institute for Consumer Research and User Experience Consulting, conducted a survey to gain an overview of the needs and perceptions of consumers in a financial world that is becoming more and more influenced by digitization. How open are they to new concepts and offers?

The survey included a total of 414 men and women ranging from 20 to 80 years of age. The majority of the participants, 57 percent, are employed full-time, while 12 percent have a part-time position and 10 percent are retired. All of the participants make decisions on financial matters in their households: In terms of financial investments and insurance, 70 percent of participants said they always or usually deal with these matters themselves, while 30 percent responded that they share these tasks with another person in the household.

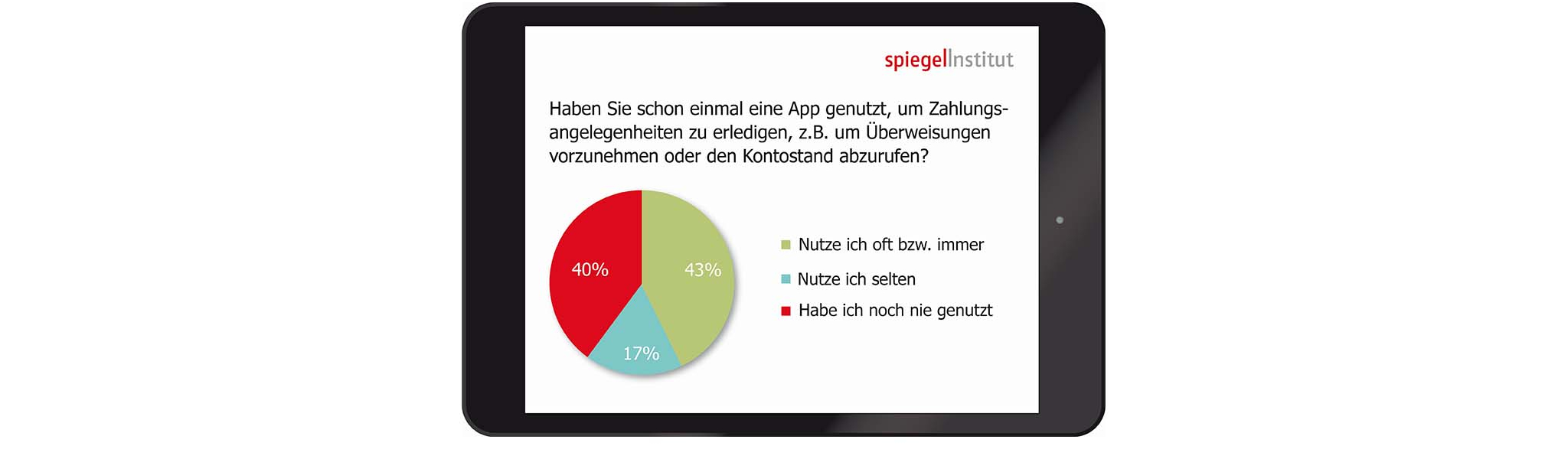

App instead of a bank teller?

Opinions differ on the subject of online banking on your smartphone. While 43 percent of respondents have never used an app to make payments or check their account balance, 40 percent indicated that they often or always use an app for such activities.

In terms of financial investments, the respondents use apps with considerably more restraint than when making payments. Seven percent of the study participants reported that they have gathered information on financial investments via an app, and only 4 percent have managed investments or made a transaction on an app thus far. The situation is similar for insurance products. In this category, 6 percent of the respondents have received information digitally via an app and even managed or purchased insurance.

Asset management on your smartphone

In the future, the topic will continue to gain significance for consumers. The participants commented on how they can envision the prospects and opportunities provided by the use of apps in various areas of everyday regarding insurance and asset management. For example, 36 percent of the participants can imagine acquiring or managing financial assets via an app. For insurance products, this rate was even 43 percent of respondents.

Regarding what consumers expect or wish to see from digital offers from financial service providers, Dirk Obermeier, Senior Director at Spiegel Institut Mannheim, pointed out that “consumer types can be categorized as conservative, prospective, or proactive”. Conservative consumers feel as if they are not yet part of the digital financial world. In particular, they would like to have more personal contact and believe the security risk when using digital financial products and services is too great. In contrast, proactive consumers have proven to be expert users who place particular importance on a greater level of individualization and improved usability. Prospective consumers represent the largest target group. These consumers are generally interested but are not yet experts and especially seek simple access, information that is easy to understand as well as a combination of online and offline offers. Therefore, it will be vital for providers of digital financial apps and roboadvisors to win over prospective consumers in this segment.

For more information on the study results, please send an email to Dirk Obermeier: d.obermeier@spiegel-institut.de

(4,655 characters including spaces)

Publisher:

Dirk Obermeier

Senior Director

Spiegel Institut Mannheim GmbH & Co. KG

Eastsite VI

Hermsheimer Straße 5

D-68163 Mannheim

Email: d.obermeier@spiegel-institut.de